Spain, Greece, Italy and Portugal, at the tail end in intangible assets' investment

SPINTAN Project Final Conference

The value of intangible assets in the public sector and its effect on economic growth was made evident at the SPINTAN Project Final Conference, held in Rome on 12-13 of September. The project, launched on December 2013, is funded by the European Union’s Seventh Framework Programme for research and technological development and is coordinated by the Ivie (Valencian Institute of Economic Research).

During its three years of existence, SPINTAN members from Spain (Ivie), United Kingdom (NIESR, Imperial College), Italy (LUISS, ISTAT), Germany (DIW, ZEW), Austria (wiiw), Sweden (Fores) and Hungary (Kopint), as well as OECD and The Conference Board, have been studying the impact of public sector intangibles on economic growth, beginning with the construction of a database coherent with the private sector database developed by INTAN_Invest, as well as with EU KLEMS project (funded by the 6th Framework Programme).

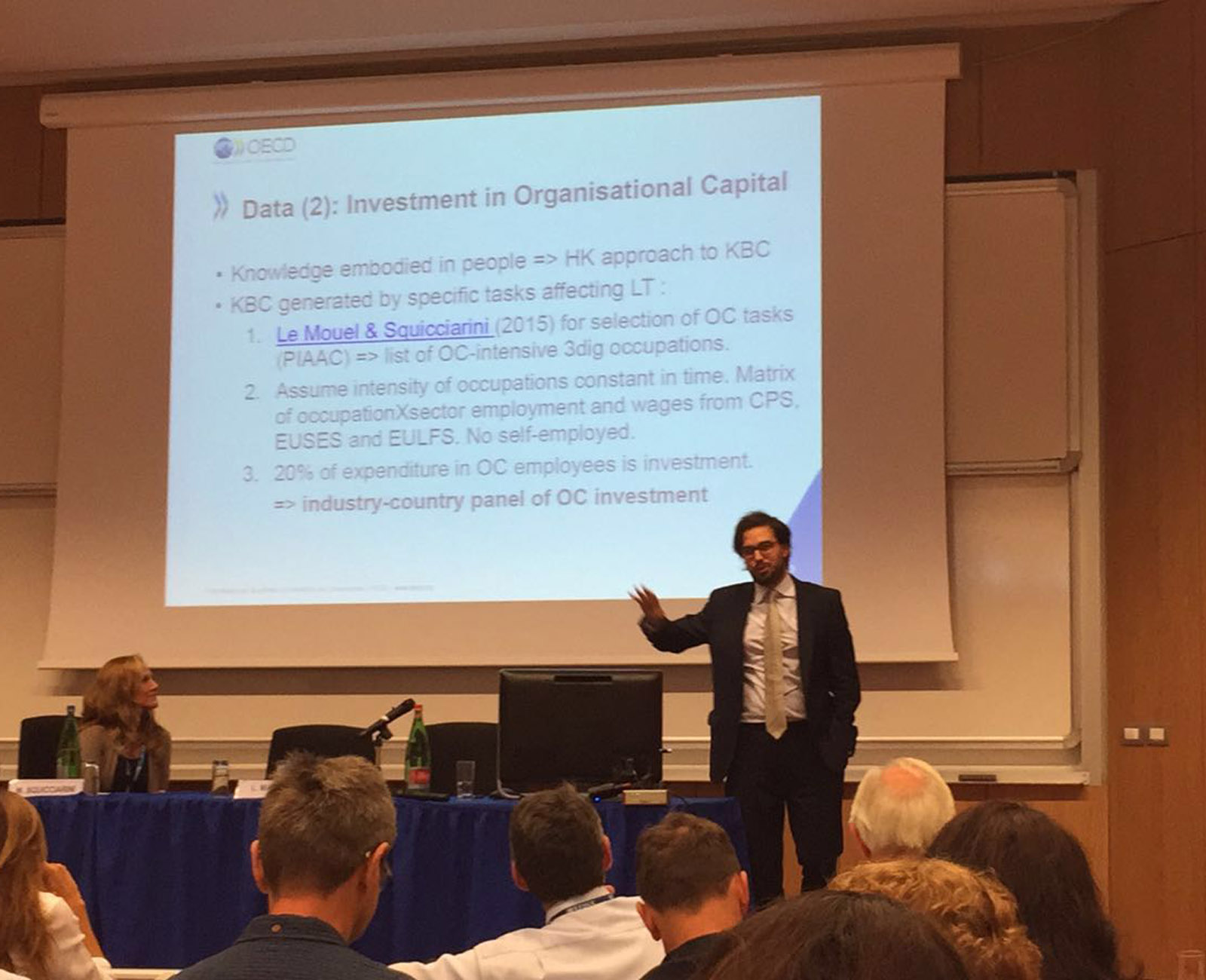

The intangible assets analyzed comprise digital economy (including software and databases), R&D, and other components that help increase the value added by firms, such as design, advertising, brands and market research. Another important set of intangibles are those aimed at improving organizational capital and workplace employee training.

The SPINTAN Project Final Conference, organized by the University LUISS Guido Carli, has served to disseminate the latest results of the research. The methodological basis has been set to analyze public investment, both in tangible and intangible assets, allowing to determine its impact on economic growth. To achieve this, the term ‘capital’ used in the public sector is broadened to include not only tangible capital (and especially infrastructure) but also intangible capital, as well as long-term social assets. Also, methods to estimate the returns on investments of public assets have been designed.

Once the methodological framework has been defined, an estimation is made for 22 European countries covering the period 1995-2011, as well as the United States, China, and Brazil for the period 1995-2013. This database allows observing both the main differences among countries and the strong positive relationship between levels of economic growth and intangible capital. Advanced economies invest more in intangible assets, with United States and United Kingdom in top positions, while Spain, Italy, Portugal and Greece lag behind.

The key results of SPINTAN will be published in November, once the project concludes. A handbook is also programmed to be released covering conceptual, methodological and statistical problems that arise when measuring public sector intangible assets. Public access to the database will also be made available.

Papers presented by Ivie researchers:

- José Manuel Pastor and Lorenzo Serrano, The research output of universities and its determinants: Quality, Specialisation and Inefficiencies in the EU. (PDF)

- Juan Fernández de Guevara and Matilde Mas , Intangibles and Infrastructures as sources of Spanish economic growth (PDF)